How to handle stock market correction

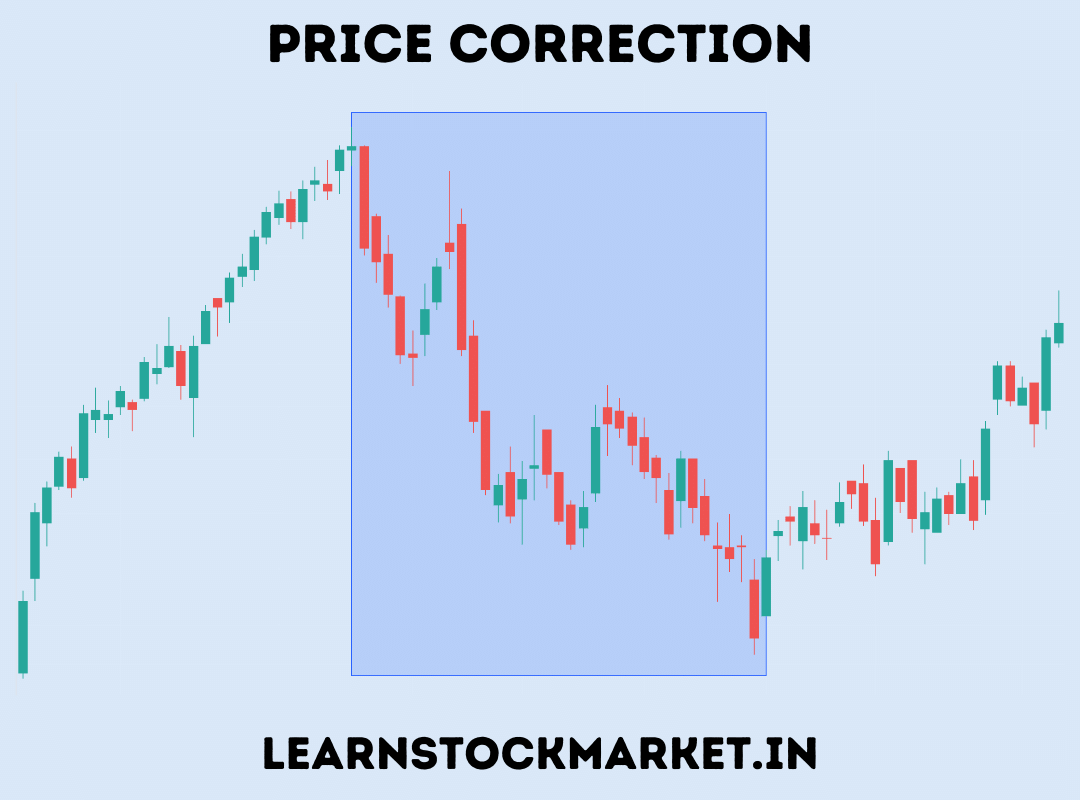

Skip to gladden The Balance Investing Retirement Planning How To Handle Stock Market Corrections Seeing your portfolio dip can be whim-whams- wracking, but occasionally it’s necessary. By Dana Anspach streamlined on December 31, 2021 Reviewed by Thomas J. Brock In This Composition frequence of Market Corrections How To repel a Correction Control the Magnitude of Corrections constantly Asked Questions( FAQs) Dealers work on the bottom of the New York Stock Exchange( NYSE) on February 6, 2018 in New York City. Following Monday’s over 1000 point drop, the Dow Jones Industrial Average briefly fell over 500 points in morning trading. Photo Spencer Platt/ Getty Images Stock request corrections are scary but normal. They are a sign of a healthy request in utmost cases. A stock request correction is generally defined as a drop in stock prices of 10 or further from their most recent peak.However, investors relate to it as a” bear request, If prices drop by 20 or further.” 1 crucial Takeaways Stock request corrections are a regularly being request condition. You should repel the appetite to trade on request corrections. Corrections are stylish survived by having a different portfolio designed to reduce threat. frequence of Market Corrections The S&P 500 Index has recorded 54 request corrections and bear requests since 1928. The longest request correction on record lasted 929 days from March 2000 to October 2002; the loftiest loss was-59 from October 2007 to March 2009.2 In 2020, the coronavirus epidemic rocked the stock request, transferring it into another bear request. But within five months, the S&P 500 had made a full recovery and set new record highs.3 How To repel a Correction Anticipating a correction can be stressful. First, repel the appetite to” time the request.” Although it’s possible to make some short- term plutocrat trading the ups and campo of the request, strategies like swing trading infrequently work for erecting long- term wealth. utmost people lose by moving their plutocrat around to share in the ups and avoid the campo. This is a documented geste

studied by academics around the world. The field of study is called” behavioral finance.” Data show that not only do utmost people warrant the discipline to stick to a winning investing playbook in correcting requests, but they also tend to distribute at the wrong times, causing indeed larger losses. Professional fiscal itineraries make portfolios grounded on wisdom versus behavioral impulses. When we produce a portfolio, we should anticipate that one out of every four timetable diggings will have a negative return. We can help to control the magnitude of the negative returns by opting a blend of investments that have moreover more implicit for downside or lower eventuality for high returns and also lower threat — a process called” diversification.” Note still, it’s stylish to understand that corrections do, and it’s frequently stylish to just ride them out, If you’re going to invest in the request. repel the appetite to trade and benefit from corrections. Follow the old Wall Street word” noway catch a falling cutter. The Dow Jones Leading Up to 2018 In the five times before 2018, the Dow Jones Industrial Average nearly doubled without any meaningful withdrawal.4 For each of those times, a significant number of judges anticipated a correction or indeed a recession. These prognostications have caused investors to pull out of the request too beforehand and lose the emotional earnings they could have enjoyed if they had not tried to prognosticate when the ineluctable would come. This is true of individual investors as well as professionals. Control the Magnitude of Corrections You can control the magnitude of the request corrections you might witness by precisely opting the blend of investments you enjoy.

Understand the position of investment threat associated with an investment. For illustration, in an investment with high threat, there’s the implicit to lose all of your plutocrat. With slightly lower threat, you might witness a drop of 30 to 50, but you wo n’t lose it all. That’s a big difference in threat. Next, understand how to mix these different types of investments to reduce the threat to your portfolio as a whole. Note Keeping your investment portfolio balanced is part of what is known as the” asset allocation” process. It’s important to reduce your exposure to significant request corrections as you near withdrawal. Once retired, you should structure your investments so that you are n’t forced to vend request- related investments when request corrections do. rather, you use the safer portion of your portfolio to support spending requirements during those times. Learn about the threat- return relationship of investing. The eventuality for advanced returns always comes with fresh threat. The advanced and briskly the price of the stock request rises, the lower the eventuality for unborn high returns. Just after a stock request correction, or bear request, the eventuality for unborn high returns in the request is advanced. In 2017, cryptocurrency came the mode. It had a return of further than 1,000 that time, and retail investors climbed to get in, while professional dealers stayed down.5 Note It’s important to understand that when prices go up that much, they will ultimately witness a severe correction. Incipiently, if you do n’t want to face the eventuality to witness a request correction, it’s presumably stylish to avoid investing in the stock request altogether. rather, stick with safer investments. But safe investments have what we call” occasion cost” you miss the occasion to set yourself up for the unborn life you fantasize for yourself and your family. The key is to strike a good balance. constantly Asked Questions( FAQs) What’s swing trading? Swing trading is when you buy and hold a stock for at least one day and as long as several weeks. The thing is to capture short- to medium- term earnings. This is in discrepancy to day trading, in which positions are held for lower than one request day. Both of these approaches are time- consuming and carry risk.However, you will generally want to buy and hold a different portfolio of stocks and other means, If you are investing for the long term. What’s diversification? Diversification is a threat operation strategy. It involves having a variety of investments in your portfolio. Diversification might involve different asset types, like collective finances, stocks, bonds, and ETFs. It might also involve diversifying within each asset type. For illustration, you might buy collective finances that concentrate on different sectors or from companies of colorful sizes. You might also diversify by having foreign investments as well as domestic bones

. The Balance does n’t give duty, investment, or fiscal advice. The information is being presented without consideration of the investment objects, threat forbearance, or fiscal circumstances of any specific investor and might not be suitable for all investors. once performance is n’t reflective of unborn results. Investing involves threat, including the possible loss of star. Was this runner helpful? Sources Part Of How the Stock Market Works Two women agitating stock portfolio allocation with laptop in front of them How the Stock Market Works 1 of 20 Woman at computer monitoring stock data What Is a Stock Exchange? 2 of 20 Dealers on the bottom of a stock exchange What Is a Stock Index? 3 of 20 what to know about the s & P 500 The S&P 500 and How It Works 4 of 20 what to know about the dow jones artificial normal Was innovated in 1896, using the stocks of just 12 companies, which were nearly entirely commodity enterprises.