Annual stocks market return of the year

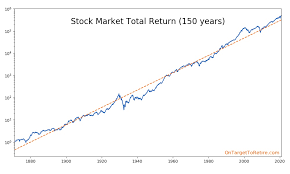

Literal Returns for the S&P 500, 1980 to 2023 By Dana Anspach streamlined on September 9, 2024 Reviewed by Gordon Scott Fact checked by Aaron Johnson In This Composition How frequently Does the Stock Market Lose plutocrat? Time in the request vs. Timing the request timetable Returns vs. Rolling Returns literal S&P 500 Index Stock Market Returns constantly Asked Questions( FAQs) Diary Organizer Date Events record Concept Photo Rawpixel/ Getty Images literal stock request returns may help you more understand your investing strategy. By looking back, you can see how volatility impacted the request during certain times and how the request recovered subsequently. Over time, the stock request has returned, on average, 10 per time or 7 when counting for affectation.1 Long- term investors can look at literal stock request returns by time to better understand how to manage their portfolios. At the bottom of this composition, you will find a table of literal periodic stock request returns for the S&P 500 indicator for the period of 1980 to 2023. crucial Takeaways The stock request has equaled positive returns for numerous times, anyhow of the negative price dips. Price drops of lower than 10 from the former high are called” request corrections.” Bear requests do when indicator prices fall 20 or further. Wealth is erected over the long run by staying in the request, investing in quality stocks, and adding further capital over time. How frequently Does the Stock Market Lose plutocrat? Negative stock request returns do, but literal data shows that the positive times far overweigh the negative times. For illustration, the 10- time annualized return of the S&P 500 Index as of Sept. 6, 2024, was about 10.4. In any given time, the factual return you earn may be relatively different than the long- term average return, which pars out several times’ worth of performance.2 Over a 10- time period, a stock request indicator could be over, but during one of the times in that 10- time period, it could have been down. When a request is passing volatility or a period of negative returns, you may hear the media talking a lot about request corrections and bear requests. A request correction means the stock request went down lower than 10 from its former high price position. This can be in the middle of the time, and the request can recover by time- end, so a request correction might noway show up as a negative in timetable- time total returns.3 A bear request occurs when the request goes down over 20 from its former high for at least two months. A bear request can last a many months or over a time, but they last 289 days on average.45 Indeed if the request gests a correction or a bear request, similar as it did in 2020, that is not to say it will not end the time on a positive note. In 2020, the stock request entered a bear request in March but ended the time up by over 18.6 Note The pattern of returns varies over different decades. In withdrawal, your investments may be exposed to a bad pattern where numerous negative times do beforehand on in withdrawal, which fiscal itineraries call sequence threat.7 Although you should anticipate a certain number of bad times, it does not mean you should not invest in stocks; it means you need to set realistic prospects when you do. Time in the request vs. Timing the request The request’s down times have an impact, but the degree to which they impact you frequently gets determined by whether you decide to stay invested or get out. An investor with a long- term view may have great returns over time, while one with a short- term view who gets in and also gets out after a bad time may have a loss.

For illustration, in 2008, the S&P 500 lost about 37 of its value.8 If you had invested$ 1,000 at the morning of the time in an indicator fund, you would have had nearly 37 lower plutocrat invested at the end of the time, or a loss of$ 370, but you only would have endured a real loss if you had vended the investment at that time. still, the magnitude of that down time could beget your investment to take numerous times to recoup its value. After 2008, your starting value the ensuing time would have been$ 630. In the coming time, 2009, the request increased by 26. This would have brought your value up to$ 794, which still comes out to lower than your$ 1,000 starting point. still, you would have seen another increase of 15, If you stayed invested through 2010. Your plutocrat would have grown to about$ 913, though still short of a full recovery. In 2011, another positive time passed and you would’ve seen another boost, but only by 2. It would not have been until 2012’s increase of another 16 that you would have been over the$ 1,000 original investment. By also, you’d have about$ 1,080.96 Note still, the 2008 down time would not have been devastating to you, If you stayed invested in the market.However, still, and moved your plutocrat into safer investments, If you vended. No bone

knows ahead of time when negative stock request returns will occur.However, also you may decide to either stay out of stocks or be prepared to lose plutocrat, because no bone

can constantly time the request to get in and out and avoid the down times, If you do not have the fiber to stay invested through a bear request. still, learn to anticipate the down times, If you choose to invest in stocks. Once you can accept that down- times will do, you will find it easier to stick with your long- term investing plan. The uplifting news is this Despite the threat associated with dipping your fiscal toes in the ponds of stock investing, America’s fiscal requests may produce great wealth for its actors over time. Stay invested for the long haul, continue to add to your investment, and manage threat meetly, and you’ll be on a good track to meet your fiscal pretensions. On the other hand, if you try and use the stock request as a means to make plutocrat presto or engage in conditioning that throw caution to the wind, you will probably find the stock request to be a veritably cruel place.However, everybody would do it, If a small quantum of plutocrat could land you big riches in asuper-short timespan. Do not fall for the myth that short- term trading is the stylish wealth- structure strategy. timetable Returns vs. Rolling Returns utmost investors do not invest on Jan. 1 and withdraw on Dec. 31, yet request returns tend to be reported on a timetable- time base. You can alternately view returns as rolling returns, which look at request returns of 12- month ages, similar as February to the following January, March to the following February, or April to the following March.